Freelancing in design offers freedom, flexibility, and the thrill of doing what you love. However, it also brings financial unpredictability. Without a steady paycheck, managing your money becomes not just important—but essential.

While financial planning may seem overwhelming at first, it doesn’t have to be complicated. With a few simple systems in place, you can transform your income from unstable to sustainable. This guide will show you how to build financial confidence step by step.

Designers often focus on visuals, not numbers. Yet, understanding your finances is just as important as mastering design tools. Inconsistent income, late client payments, and lack of benefits can make financial security feel out of reach. That’s why proactive money management is key.

Here’s what happens when you manage your finances wisely:

Ultimately, good money habits let you focus more on creativity and less on financial anxiety.

To take control of your money, start by understanding where it goes. Tracking your income and expenses lays the foundation for smarter decisions.

Several free or affordable tools can help freelancers track their finances:

As you log each transaction, be consistent. Include every payment you receive and every expense—no matter how small.

After tracking, categorize your expenses. For example:

This breakdown reveals spending patterns and highlights areas for improvement.

Budgeting may sound restrictive, but it’s empowering. It gives you a clear picture of what’s possible—and what to avoid.

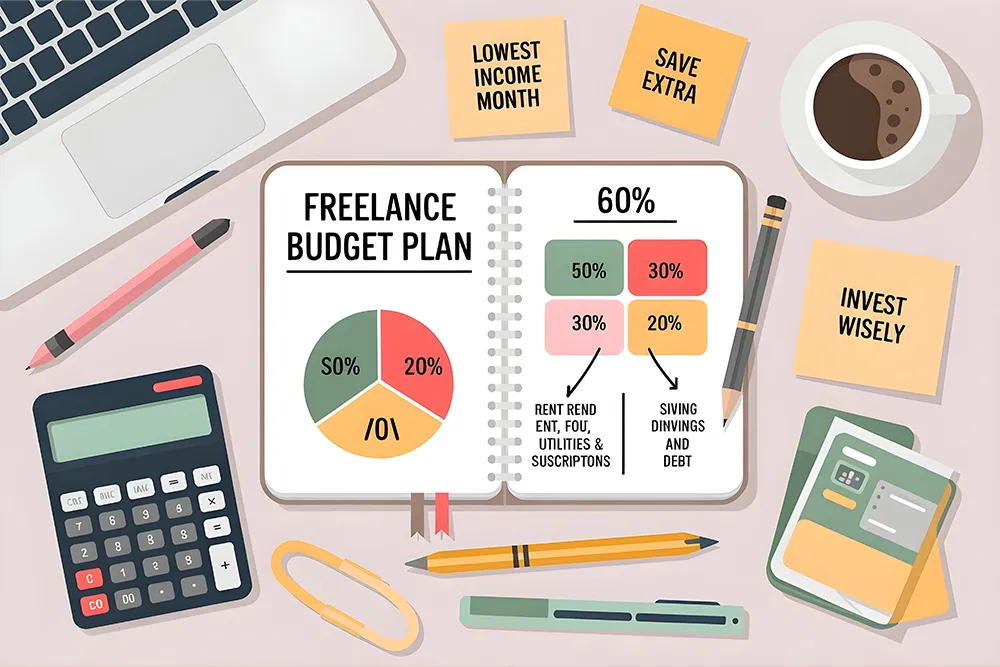

You can adapt this classic rule to fit your freelance lifestyle:

However, before you apply these percentages, set aside money for business costs and taxes. A smart breakdown could look like this:

Plan using your lowest monthly income from the past year. This approach helps you avoid overspending during high-income months. When you earn more, you can save the extra—or invest it.

Freelancers don’t have access to company benefits like paid sick days or unemployment insurance. Therefore, creating your safety net is critical.

A good rule of thumb is to save three to six months of essential expenses. This cushion gives you time to find new clients or recover from personal setbacks.

If that number feels overwhelming, start small. Even saving $25 a week can build a meaningful reserve over time. Automate it if possible, so the habit sticks.

Mixing personal and business money creates confusion—and often leads to financial trouble. To stay organized, set clear boundaries between your personal and professional accounts.

Use a dedicated business bank account to manage client payments and work-related expenses. Doing this simplifies bookkeeping, makes taxes easier, and gives you a clearer view of your business health.

You can also use a separate credit card for design expenses. Many cards offer cashback or perks that benefit freelancers.

Taxes can be a huge pain point for freelancers—especially if you’re not setting aside money throughout the year. The good news? With a little preparation, you can avoid the last-minute scramble.

For each client payment you receive, immediately move 25% to 30% into a separate savings account. This becomes your tax fund.

Platforms like FreshBooks, Bonsai, and PayPal Invoicing make it easier to calculate and apply taxes. They also help deductible track expenses, such as:

When tax season rolls around, consult an accountant who understands freelance work. This ensures you get every deduction you’re entitled to.

Even with fluctuating income, you can create stability by paying yourself a consistent salary. This practice helps smooth out your budget.

By doing this, you separate your role as a business owner from your finances, making both easier to manage.

Freelancers don’t receive employer-sponsored retirement plans. But that doesn’t mean you can’t build wealth for the long term.

Start with small contributions if needed. Over time, compound interest works in your favor. Automating your investments makes the process effortless.

Financial plans aren’t set in stone. Your income, expenses, and goals will change—so your money plan should too.

Choose one day each month to check-in. On this day:

These small reviews prevent major surprises later.

Managing money wisely also means knowing when to reinvest in your business. Strategic investments can increase your earning potential over time.

These investments boost your productivity and allow you to charge more confidently.

Freelancing isn’t just a job—it’s a business. And as the CEO of that business, financial confidence is part of your toolkit.

With consistent tracking, smart budgeting, and proactive planning, you can build a sustainable creative career. Remember, you don’t need to be a financial expert. You just need the right habits, the right tools, and the mindset to treat your creativity like the valuable business it is.

Recommended Reading from Figuree Studio:

Anarchy Brothers - Strong Brush Font

$21 – $1,299Price range: $21 through $1,299

Anarchy Brothers - Strong Brush Font

$21 – $1,299Price range: $21 through $1,299 Azkanio - Charming Script Font

$21 – $1,299Price range: $21 through $1,299

Azkanio - Charming Script Font

$21 – $1,299Price range: $21 through $1,299 Rafots Signature - Classy Font

$21 – $1,299Price range: $21 through $1,299

Rafots Signature - Classy Font

$21 – $1,299Price range: $21 through $1,299

Elevate your projects with premium freebies. Fonts, graphics, and templates handpicked for creators like you — download them all today, free forever.

Download Freebies